What is Medicare?

Medicare debuted in 1965 when President Lyndon B. Johnson signed a bill that created both Medicare and Medicaid.

The programs’ purpose was to provide healthcare access for Americans who had difficulty getting it—namely older adults and those with limited incomes.

The Medicare program is administered by The Centers for Medicare & Medicaid Services (CMS), a division of the US Department of Health and Human Services (HHS) that is overseen by the President.

The 10 dos and don’ts of Medicare

If you’re new to Medicare, you may worry about making a mistake.

Whether you’re anxious about missing those important enrollment periods or picking the right plan, we’re here to help.

Here are a few Medicare dos and don’ts to ease the anxiety.

- Do become a Medicare know-it-all. We understand; Medicare is complicated. Take a moment to educate yourself early on to save time and money.

- Do learn how and when to sign up. To avoid coverage gaps and late enrollment fees, learn when enrollment periods are and the rules for signing up.

- Do consider Part A even if you don’t qualify for premium-free coverage. Are you one of those who must pay if you want to get Part A coverage? You may still want to enroll to protect yourself in case you need care.

- Do understand how your other coverage works with Medicare. Check out the section below about Medicare and other insurance. You may be able to keep your current coverage when you’re eligible for Medicare.

- Do know what’s covered and what you’ll pay for care. Whether you enroll in Advantage Plans (Part C) , Supplementals, or Prescription Drug Coverages or you keep the Original Medicare—learn the details. (IF you decided to keep Original Medicare YOU need to buy Part D, Prescription Drugs Coverage).

- Do ask which type of plan may be best for you. Get help deciding which kind of Medicare coverage may best fit your health and budget needs.

- Don’t drop your employer coverage just because you have Medicare. If you’re enrolled in your or your spouse’s employer or retirement plan, don’t assume you need to get rid of it.

You may be better off keeping the plan and delaying your Medicare start date. (Just make sure you won’t be penalized!) - Don’t put off treatment if you need care. Medicare may not cover every penny of your health costs, but don’t put off getting care if you need it to stay well. Staying healthy should be your top priority.

- Do consider getting more help with costs. If you have limited resources, you may qualify for one of several programs that could help you pay for your Medicare costs and coverage.Medicaid, and Extra Help are programs that you may consider.(You might be able to have Medicare and Medicaid , Dual eligibility)

- Don’t do it alone. Medicare can seem “daunting” if you’re figuring it out alone. Reach out to talk to Isuperco’s licensed insurance agents who can guide you through the process is a smart move!

If you need to talk , we can help!

Contact one of our licensed agents at 754-205-4871 or send a text message to 786-227-8918.

Medicare Open Enrollment

We’re available during the following dates and times:

- October 15 to December 7: Weekdays from 8 a.m. to 7 pm and Saturday 10 am to 5 pm

- December 8 to October 14: Weekdays from 8 a.m. to 7 pm

By appointments ONLY !

Don’t wait, call now!

Isuperco Corp is a Free Service company always !!

Important information:

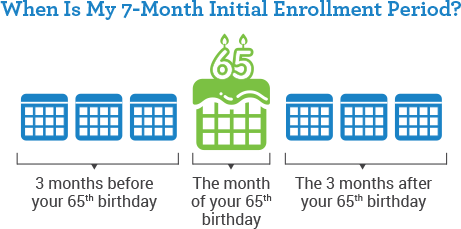

If you turning 65 please contact us 3 months before until 3 months after!

You have 7 months enrollment period!

What Medicare covers?

Part A – Hospital insurance

Part A helps pay for the costs of staying in the hospital plus more services.

Here are common categories of Part A-covered services.

- Inpatient hospital stays and procedures

- Skilled nursing facilities

- Nursing homes

- Hospice care

- Home health care following an inpatient stay

- Blood you get in the hospital (after the first three pints each year)

- For more details please contact us!

Part B – Medical insurance

Part B covers 100% of many preventive services, which includes services like these.

- Counseling, therapy, and training:

- Alcohol dependency counseling

- Behavioral therapy to help lower your risk of heart disease

- Diabetes self-management training

- Medical nutrition therapy

- STI counseling

- Tobacco-cessation counseling

- Doctor visits:

“Welcome to Medicare” preventive visit Annual wellness visit

- Screenings and tests:

- Abdominal aortic aneurysm screenings

- Alcohol misuse screenings

- Bone mass measurements

- Breast cancer screenings (mammograms)

- Cardiovascular disease screenings

- Cervical and vaginal cancer screenings

- Colorectal cancer screenings

- Depression screenings

- Diabetes screenings

- Glaucoma tests

- Hepatitis C screenings

- HIV screenings

- Lung cancer screenings

- Obesity screenings and counseling

- Prostate cancer screenings

- Sexually transmitted infection (STI) screenings

- Shots and vaccinations:

- Flu shots

- Pneumococcal vaccines

- Hepatitis B vaccines

Another part of Part B is 80% coverage for the cost of most medically necessary services and items, including the following:

- Ambulance transportation services

- Blood and medical supplies

- Doctor visits

- Durable medical equipment (hospital beds, wheelchairs, walkers, etc.)

- Home health services

- Lab tests

- Outpatient care

- Surgeries

- X-rays

Part B may also cover these services:

- Clinical research

- Mental health services

- Second opinions before surgery

- Limited outpatient prescription drugs

Coverage for Part B services must be determined medically necessary or preventive.

Part C – Medicare Advantage plans

Medicare Advantage, or Part C, plans are optional private plans that replace Part A and Part B but must have at least the same benefits.

Sometimes, Advantage plans include more coverage than Original Medicare, such as these benefits:

- Prescription Drugs

- Dental services

- Vision services and eyewear (glasses, contacts)

- Hearing services and hearing aids

- Gym memberships

- Health and well-being programs

With some Part C plans, beneficiaries may only visit doctors who participate (have a contract) with the plan’s provider network.

WE SELL THE PART C PLANS !

Part D – Prescription Drug Plans (PDPs)

If you already have Part A and Part B, you’re eligible for Part D, too, and you have two ways to prescription drug coverage. You can buy a stand-alone Prescription Drug Plan (PDP), or you may be able to choose a Medicare Advantage plan with built-in prescription drug coverage.

The prescriptions that Part D helps you pay for depend on the plan’s “formulary,”† or list of covered drugs. Your plan’s formulary may have different coverage for drugs depending on whether they are generic or brand name or whether they come from a retail or specialty pharmacy.

Part D coverage also usually has different levels of coverage called “tiers.” These tiers are numbered, usually as Tier 1, Tier 2, and so on. Check your plan’s summary of benefits to see if the medications you take are covered and how.